In the second of or two-part report, IT Reseller again talks with a group of leading resellers/VARs about a number of critical issues surrounding Auto ID systems and related service provision.

With many products and services being commoditised, and in particularly challenging economic times, what do resellers/VARs consider to be some of the most critical value-added solutions and services offerings that they feel they increasingly need to provide to their end customers? Paul Clark of BlueLeaf (a partner of distributor Blackroc Distribution), cites maintenance contracts as a key value add; including abuse, along with free technical support. A lot of our customers are small- to medium-sized enterprises and cannot afford the time to get up to speed on all the intricacies of the latest handheld devices, he said. Therefore we offer a 90-day warranty period where we will fix any errors in our software or the supplied supporting software and train/coach our customers until they are confident in the system and are able to support themselves after that time our services are chargeable. But the customers appreciate that 90-day safety net and it wins us business.

With many products and services being commoditised, and in particularly challenging economic times, what do resellers/VARs consider to be some of the most critical value-added solutions and services offerings that they feel they increasingly need to provide to their end customers? Paul Clark of BlueLeaf (a partner of distributor Blackroc Distribution), cites maintenance contracts as a key value add; including abuse, along with free technical support. A lot of our customers are small- to medium-sized enterprises and cannot afford the time to get up to speed on all the intricacies of the latest handheld devices, he said. Therefore we offer a 90-day warranty period where we will fix any errors in our software or the supplied supporting software and train/coach our customers until they are confident in the system and are able to support themselves after that time our services are chargeable. But the customers appreciate that 90-day safety net and it wins us business.

Stephen Burnett, managing director at the Retail Data Partnership (a partner of distributor ScanSource Europe), has no hesitation in pointing to a good level of after-sales service. Its crucial in our sector, he said. As for Simon Rowland, CEIO at Customer Research Technology (CRT a partner of distributor ScanSource Europe), he believes that the provision of a one-stop-shop service to the end customer is vital. Our clients need to be able to rest assured that all aspects of the products, services and ongoing support are taken care of by us, he remarked. This must be more than just words and promises. We have clearly defined Service Level Agreements (SLAs), which set out what each party can expect at all points in our relationship. The SLA sets the expectation levels; it is then up to us to exceed their expectations.

Unspoken plea

Les Morley, financial director at Pen Mobile (a partner of distributor Varlink), points out that his company receives many calls from customers that start with I am looking for a . Some of them actually want what they are asking for, but, for most, there is an unspoken plea will somebody help me?, he said. If your business tends towards developing a strong and loyal customer base by the creation of firm professional relationships, then you are probably already considering all aspects of the sales service and apply a degree of flexibility in how you deal with each client interaction. Someone wanting a replacement battery doesnt want to spend 15 minutes doing needs analysis, whereas someone wanting a complete new IT solution for a problem will require a lot of help. There are various ways to build trust and confidence and establish that all important feel good factor. Site visits, demo units and proto-cycling software development are all available options too. That flexibility extends beyond the sales interaction into areas of support even financing. Finance terms can be offered, where appropriate, as well as leasing or rental. Morley adds that he has been watching with interest some vendors who have packaged their software solutions as a managed service. I think there may well be mileage in that, he said. We already offer a managed service option on some of our parking software solutions and, for smaller companies with little IT knowledge, we believe this is an attractive way ahead.

Just-in-time supply

Do our commentators supply various vendors solutions in each vertical technology sphere, or do they prefer to source from one supplier? Rowland points out that CRT is an advanced business partner with IBM and has chosen to take supply from distributor ScanSource in terms of the majority of products. We need just-in-time supply and, as a lean operation, really value true partnership to ensure the best support levels are available to us at all times we commit to our suppliers and they commit to us, he said. Burnett only uses one supplier for one brand (IBM). In order to provide excellent support, it is much easier to manage this if you have limited varieties of hardware out in the field, he argues.

Clark supplies all kinds of equipment including RFID from his companys website to different verticals, although I do lead with Psion kit quite often in the handheld data collection marketplace, he clarified. I have taken this route for a number of reasons. It would be foolish to only push/sell one vendors kit supplied via Blackroc. We provide a variety of equipment Intermec, Psion, Datalogic, CipherLab, Nordic, Zebra and Martell. If you only offer one vendors equipment it is difficult to cross-sell should you meet resistance from a potential customer. Having more goodies in your bag offers more chances of landing the deal.

Morley cannot think of any manufacturer that has dominated any vertical technology area in terms of the quality and price of their product to such a degree that they preclude consideration of other products. For sure, there are instances where a particular product is a market leader; but only for a while, he said. The competition is always hot on their heels. Reflecting his companys customer-centric ethos, Morley prefers to evaluate the best options at the time and point out the options to the customer. Recommendations are never predicated on margin, and that allows us to promote our integrity as preferred partners, without fear or favour, he said.

Two-way relationship

And what do resellers consider to be some of the most important extra-value services that they are increasingly required to provide to the vendor and/or distributor partner community? Clark points out that Blueleaf provides an outlet for the distributor or vendor to push their products. I provide software so the vendors can provide a full solution through my company, he said. Otherwise the vendor is just shifting a terminal with nothing (eg. software) to make it function. Clark adds that Blueleaf can also insulate the distributors from the end users. They do not want to be bothered with trivial questions about how a certain function works on a machine; that is our job and that is why they provide us with a margin to accomplish that task for them, he remarked.

And what do resellers consider to be some of the most important extra-value services that they are increasingly required to provide to the vendor and/or distributor partner community? Clark points out that Blueleaf provides an outlet for the distributor or vendor to push their products. I provide software so the vendors can provide a full solution through my company, he said. Otherwise the vendor is just shifting a terminal with nothing (eg. software) to make it function. Clark adds that Blueleaf can also insulate the distributors from the end users. They do not want to be bothered with trivial questions about how a certain function works on a machine; that is our job and that is why they provide us with a margin to accomplish that task for them, he remarked.

Morley stresses that his companys relationship with its distributors is of critical importance to his companys business. After all, we are all working on different elements of the same supply chain, he remarked. I am sorry to say that there are huge differences in the quality of service and support that we get and this of course influences our purchasing patterns significantly. But it is important that this relationship is two way, and resellers have their part to play. The right equipment, shipped when and where it is supposed to go, sourced at a competitive price, and supported by an efficient accurate and timely back-office operation first attracted us to increase our purchases through distributor Varlink. But now, based on the confidence that this good service has created, we find ourselves working increasingly hand in hand. Morley adds that this collaboration works on several levels, such as forward planning in the sales and supply chain (based, for example, on sales forecasting or stock-level agreements), joint enterprise marketing and sales support, and product evaluation. Although anticipating sales volumes by make and model is very difficult, especially in the present climate, we try to give distributors some indication of what is in the pipeline, he said.

Do our commentators feel there is still a strong market case for the dedicated specialist reseller/VAR who concentrates on one or two technology vertical areas, or do they believe that, today, there is a stronger business case for a more broad-line service offering? According to Rowland, focus is almost everything, which is why niche is good, he says. Without focus, a business continues to struggle to find its true identity. With focus, a company knows why it exists and what it is to do, and therefore can assess its progress against well-defined targets. Of course, a broad-line offering can be strategically the right approach; if thats the focus. However, the fact remains that differentiation and true value added services are the keys to gaining market share. As for Burnett, his preferred route is to concentrate on having a very narrow focus. This means that we can build a reputation in our chosen market sectors, he said.

Case for specialism

Adrian Harris, sales director at EXPD (a partner of distributor Varlink), also believes that the case for specialist resellers/VAR has never been greater. We have purchased Auto ID equipment from the huge IT resellers there is absolutely no doubt that it is a purchase on price alone with no pre-sale attention to detail; ie. you buy a part number, he said. However, to the credit of the big resellers, they do not claim to be anything else. I believe its the manufacturers who open these channels in the hope of increasing volume; the net result is the product gets devalued and becomes available to all resellers through the channel, irrespective of the level of knowledge and experience of that particular product.

Clark, on the other hand, doesnt think that there are any specialist areas that are large enough in the Auto ID space, such as RFID, to support an entire business. So, really a broad approach in my view is the sensible approach, he reflected. This means that you are not turning business away because it is not your area. I have seen that a few companies who do choose niche specialised areas have struggled recently; RFID being a good example.

James Hannay, senior VP, Northern Europe, Zetes, agrees. I think that, going forward, the most successful companies will be those that can offer a much broader service and the ability to consult on business processes, he said. Users want to work with supply chain experts who can analyse business processes, map the required software processes, align the two and then deploy and support the final system to give them a real-time view of business performance. That is what a system integrator does, and this is what Zetes does for its client base. We work with our customers to, first, examine their business processes and performance before we consider which one, or combination, of our applications should be deployed. So, for instance, we might implement voice in one part of the warehouse and ePOD or data capture in another, integrating all the relevant data to be held in a single repository in real time. The advantage to the customer of working with a supplier at this level is that it minimises the cost of ownership because they have a single point of contact with fewer suppliers and disparate systems to manage.

Shrinking world

Has globalisation affected our commentators businesses to any extent? Burnett reports a resounding no. We are a UK-focused business, and our customers have local catchments, he said. As for Rowland, he points out that the directors at CRT have gone through the passport for excellence programme, and recently work has started on assessing the best export strategy, as this is not just a case of shipping kit and software abroad. Globalisation has shrunk the world and brought significant new markets much closer, he said. However, franchising, licensee programmes, subsidiaries or putting your own people on the ground all need to be considered. Rowland adds that the UK market, as the fifth biggest world economy, has kept CRT very busy and the company has made the decision to explore other markets, but not to rush out internationally. We currently have less than 1 per cent of our home market so lots more available here, he said.

Clark explains that global activity has not dominated Blueleafs business focus; although the company does get contacted by more companies abroad than it used to, and it does sell some handhelds and RFID readers and tags into Europe. We do now get a lot more hits on our website from all around the globe, adds Clark. It amazes me, though, that some unsavory customers still rear their heads from time to time, saying something like I saw product X on your website and would like to buy 25 on my credit card for immediate shipment to Singapore. Yeah, dream on fella. Having been bitten once (fortunately, for only a small amount) I have learnt that lesson. Resellers would be advised in this credit crunch not to take orders that appear out of the blue at face value, however tempting they may seem. And continuing the theme of web responses, Harris makes the point that having pricing so easily available on the Internet has meant that his company now has to focus much more on the added value services it provides.

From Hannays perspective, globalisation has definitely enhanced Zetes business and he believes it will continue to do so. We operate in 13 countries so our customer credentials are now spread across these countries, meaning we can reference successes across a very wide region, he said. We are now helping our customers learn from their peers across Europe in a way that removes any competitive conflict. In addition, it promotes sharing of best practice because different countries are at different stages both economically and in their adoption of supply chain technology.

International deployment

Hannay sees a big part of Zetes future role in being able to continue facilitating peer-to-peer education and promoting industry best practice. In addition, he remarks that globalisation has created a demand for suppliers capable of implementing a single solution across different operating countries that are also supported from a single and distributed support infrastructure. We are experiencing a high demand for a single integrator in multiple countries, he said. The benefits to the user are the consistency of using a single solution across all the countries and having only one supplier for all support and future development. As the global economy continues to contract we see international deployments as a key growth area because they offer larger international organisations the combined benefits of improved operational efficiencies with consistent pricing support and service level agreements.

What are some of the value-enhancing services that VARs look for from their distributors and vendors of choice? Burnett believes support with marketing is key, while Harris homes-in on knowledge, product range and stock/price availability. For Morley, it comes down to a proven, strong partnership plus reasonable credit lines and the flexibility to handle elephants.

Clark points out that his distributor, Blackroc, does a great job of configuring terminals before they arrive. He also values a regular visit from the distributors account manager. I look to my distributor to keep me up to date with new vendor kit and anything new on the market, he adds. For Rowland, the most basic value add for CRT is just-in-time stocking of key products. We work lean and this means we keep the sales order to invoice to shipping to implementation time frames to a minimum, he said. We have no facility for stock holding and require our vendors to manage this key area. CRT doesnt currently use pre-configuration services but we have access to this and will be using it in the future as demands on our resources increase. Rowland added that CRT draws on the vendor resource for product information, technical specifications and future development information. This is another area that benefits from a partnership approach where two companies work for mutual benefit, he remarked.

Driving innovation

Hannay believes the role of the hardware manufacturer is to drive innovation and create market demand, enabling integrators such as Zetes to service this demand. For instance, Vocollect has done an excellent job of creating the market for voice, allowing Zetes and other companies to fill the void and service market demand with feature-rich applications, he said. Our goal is for hardware vendors to create markets that are ready in two to three years time. During this time, Zetes will invest in developing the relevant software applications and integration skills to meet that demand as the market matures.

Hannay believes the role of the hardware manufacturer is to drive innovation and create market demand, enabling integrators such as Zetes to service this demand. For instance, Vocollect has done an excellent job of creating the market for voice, allowing Zetes and other companies to fill the void and service market demand with feature-rich applications, he said. Our goal is for hardware vendors to create markets that are ready in two to three years time. During this time, Zetes will invest in developing the relevant software applications and integration skills to meet that demand as the market matures.

And what are going to be the next notable advances to leverage advantage for both the channel and the end user? Hannay believes that one of the biggest developments will come with the arrival of multiple delivery channels to the end user; for example, Software as a Service (SaaS) combined with more traditional deployments; such as giving users the choice of either renting the system over a five-year period, or purchasing the system outright with a five-year support agreement. As for other future developments, Burnett anticipates possible developments in the realm of self-service kiosks and 2D barcodes being used for verification and authentication of vouchers, etc. While Rowland believes that, within the research technology space, there will be a number of key players who will dominate. Their systems are likely to be bespoke and proprietary, leading to a need for customers to either place all their business with one provider, or else look at integration as a means to holistically manage their research, he remarked. Multi-channel feedback is being discussed and encouraged at a strategic level, through papers such as the Lord Varney Report. This states that the public sector should gain feedback from their service users through a differing range of research mediums in order to ensure that the feedback is accurate and balanced. Were seeing the need for true multi-channel data feedback options and have developed ViewPoint RCS such that integration with multiple devices is near seemless. This will be essential in the future, as the public service user becomes part of the means for setting agendas in areas such as policing, council services, health services and leisure. The VAR will need to provide the full range of devices, services and associated support to accommodate small PDA requirements, through to Tablet PC and larger touch screen kiosks, as opposed to single device high volume sales.

Further convergence

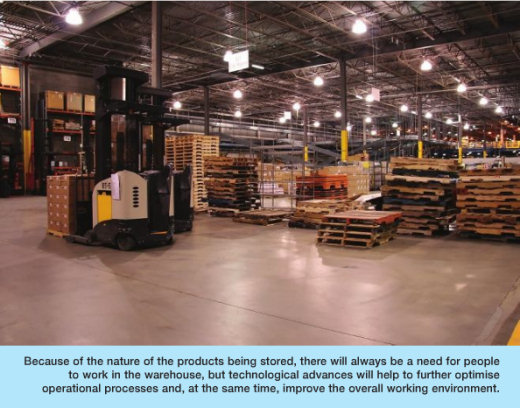

Hannay believes we will see further convergence occurring within the marketplace to ultimately leave just one or two hardware manufacturers delivering a single set of products. Increasingly, these products will offer multimodal capabilities just as we have seen with the mobile phone industry, he said. Zetes has a responsibility to proactively monitor market developments and ensure we are equipped for the future, investing today in developing the right capability to be able to deploy into customers tomorrow. Hannay also anticipates convergence occurring in the use of multiple technologies; for example, combining voice, barcode scanning with handheld computers, smart cards and RFID. The warehouses of the future will be ever more reliant on automation to eliminate errors and reduce training times, said Hannay. Because of the nature of the products being stored, there will always be a need for people to work in the warehouse, but technological advances will help to further optimise operational processes and, at the same time, improve the overall working environment.

Engaging the SME

Morley anticipates a growing trend concerning mobility, but makes the point that prices will have to reduce in order to engage the interest of more SMEs. He also believes that biometrics will play an increasing role. As for RFID, Morley reflects that this has yet to happen in terms of substantial market uptake, while Clark cites RFID as something to increasingly look out for in the future. However, he believes that there are many traps to fall into here if companies are not careful. I think that experienced companies will benefit in the long term, but anyone who thinks they can sell that and make a few quid will end up with egg on their face as it is a technical sell and you need a good understanding of the physics involved to be successful at it, he said. Systems that do not work or are poorly thought out will tarnish the image of RFID and alienate end users. Nevertheless, Clark expects RFID to play a bigger part in our industry in the future; although I would expect some new technology to appear over the next five to ten years.

Add a Comment

No messages on this article yet