The Forum of Private Business (FPB) is concerned that the 2009 Budget has failed to address the main issues threatening the UKs struggling small businesses.

Proposals to improve access to finance, ease the burden of costs and stimulate economic activity were absent from the announcement. In addition, although the Government has unveiled a new 1.7 billion job creation fund, nothing has been done to help smaller employers hold on to their key staff.

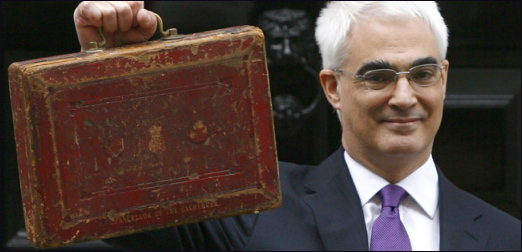

"We are experiencing the worst economic conditions that most business owners have ever seen. We needed a bold strategy for business recovery, which the Chancellor has failed to deliver at all levels," said Noel Guilford, the FPBs National Chairman. "The FPB made numerous and significant proposals which would have had the effect of providing immediate help to struggling businesses, nearly all of which appear to have been ignored."

In its latest quarterly Referendum survey, members of the FPB voted for restoring business confidence (65%) and restoring consumer confidence (63%) as the two issues they most wanted the Government to prioritise in the Budget in order to support their businesses. The FPB addressed four key elements in its submission to the Government:

Improving access to finance for small businesses

Minimising the cost burdens of small businesses

Protecting employment

Improving economic activity

Improving access to finance for small businesses

The FPB had also urged the Government to monitor the banks more effectively to ensure that measures such as the Enterprise Finance Guarantee (EFG) and quantitative easing directly address restrictions in credit. Of particular concern is the viability of the Small Business Lending Monitoring Panel, which has met on just five occasions since it was set up in November 2008. While the Chancellor discussed regulating the banks behaviour, he did not commit to scrutinising the availability and cost of lending.

In addition, although the FPB called for better protection for businesses suffering from increasing late payments, many businesses will not qualify for the new 5 billion credit insurance scheme, which is temporary (it will come into effect on 1 May and cease taking applications on 31 December 2009), and will only be available for businesses that have had their credit insurance cut from 1 April 2009. Companies which have had it withdrawn completely will not be covered.

Minimising the cost burdens of small businesses

Although doubling some capital allowances and extending loss carry-back will help some small businesses with their cash flow difficulties, none of the FPBs proposals to reduce the burden of creeping costs, including cutting the lower rate of corporation tax to 20%, scrapping increases in fuel duty and freezing the minimum wage were adopted by the Government. In addition, measures to ease rates costs, including making enrolment for Small Business Rate Relief automatic, reconsider imposing supplementary business rates and freezing the scheduled 5% increase in business rates (the Government is instead spreading out the increase over three years) were not taken up.

Protecting employment

The FPB is concerned at increasing employment costs. These include measures designed to protect workers, which could backfire and increase unemployment because many employers will not be able to afford them and will be forced to close their businesses. The FPB called for minimum redundancy pay to be frozen, but the Chancellor stuck by plans increase it from 350 to 380. In addition, National Insurance (NI) contributions will still increase from 2011, a disincentive to recruitment when businesses hit by the recession could be in a position to take on staff again.

Further, a job creators allowance scheme, and a modified Working Tax Credit scheme, which would allow employees on shorter working hours to have their pay supplemented, did not materialise.

Improving economic activity

Finally, despite the FPBs latest Referendum survey suggesting that some businesses are experiencing a slight improvement in markets, the Government has not produced a plan to stimulate economic activity by opening up public contracts to small firms. In addition, rather than a fund to stimulate house builders, a special lending scheme for first-time buyers would have provided a genuine stimulus to the housing market.

The FPBs Chief Executive, Phil Orford, said: "The Chancellor has missed a vital opportunity to produce a Budget for business survival and economic growth. We called for a real and sustained support strategy, acting as a catalyst for broader economic recovery, but instead we got a Budget that appears to be focused on the next general election.

"While some of these measures will benefit low-carbon companies and new technology start-ups, they will do little to restore business and consumer confidence and stimulate economic activity.

"Although the long-term unemployed will benefit from investment in job creation and training from 2010, nothing has been done to help businesses retain their existing skilled workforce, which continues to be decimated as a result of the recession.

"While welcoming changes to capital allowances and loss relief, the reality is that these will have only provide limited benefit to smaller businesses. In addition, restrictions to the new credit insurance scheme and the failure to address business taxes remain considerable barriers to business survival and growth."

Add a Comment

No messages on this article yet